Options trading can sometimes feel like learning a new language—there’s Delta, Theta, Vega, and our star of the show today: Gamma. If you’ve ever traded options, you may have heard that Gamma is always positive for a long put. But why is that? And more importantly, how does it affect your trades?

Gamma: The Accelerator Pedal of Delta

Think of Delta as your car’s speedometer—it tells you how fast you’re going, or in options terms, how much an option’s price changes in response to a $1 move in the underlying asset. Now, Gamma is the accelerator pedal. It determines how quickly Delta changes as the stock moves.

In technical terms:

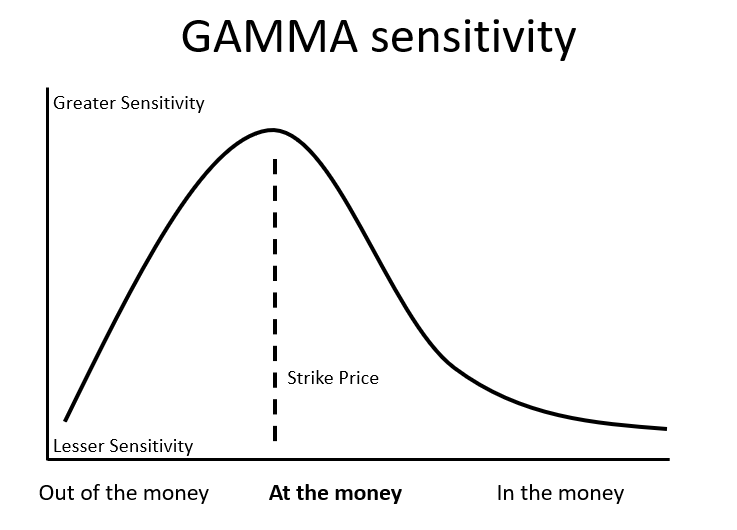

- Gamma measures the rate of change of Delta per $1 move in the underlying asset.

- A high Gamma means Delta changes rapidly; a low Gamma means it changes slowly.

- Gamma is highest for at-the-money (ATM) options and decreases as options move in-the-money (ITM) or out-of-the-money (OTM).

Why Is Gamma Important?

Gamma matters because it determines how quickly your position can become more profitable or more risky. If you’re holding a long option with high Gamma, small stock price movements can dramatically impact your Delta, making your position more sensitive to price changes.

For example:

- If you hold a long put and the stock price drops, your put’s Delta becomes more negative.

- Since Gamma is positive, it pushes Delta further negative, increasing the rate at which your put gains value.

This is why long options traders love positive Gamma—it helps their positions grow in value more quickly when the trade moves in their favor.

Gamma and Expiration: The Time Bomb Effect

One of the most interesting things about Gamma is how it behaves as expiration nears. Gamma increases significantly for ATM options as expiration approaches. This means your Delta can swing wildly with even the smallest price movements.

📌 Fun Fact: This is why professional traders, especially market makers, hedge their positions carefully. If they don’t, a sudden price jump could leave them seriously exposed.

✔ Gamma measures how fast Delta changes as the stock price moves.

✔ It’s always highest for ATM options and drops for deep ITM/OTM options.

✔ Positive Gamma helps traders when they’re in a winning position.

✔ As expiration nears, Gamma spikes for ATM options, making positions more volatile.

In options trading, Gamma measures the rate of change of Delta as the underlying stock price moves. If that sounds like math class all over again, don’t worry—I promise it’s not as scary as it sounds.

Here’s a simple breakdown:

- Delta tells you how much the option’s price will change when the stock price moves.

- Gamma tells you how much Delta will change when the stock price moves.

In other words, Gamma controls the speed of Delta’s movement. A high Gamma means Delta is changing rapidly. A low Gamma means Delta is changing slowly.

To put it in real-world terms: Gamma is like the gas pedal of your car. When you press it (Gamma is high), your speed (Delta) increases quickly. When you ease off (Gamma is low), your speed changes gradually.

Quick Example of Gamma in Action

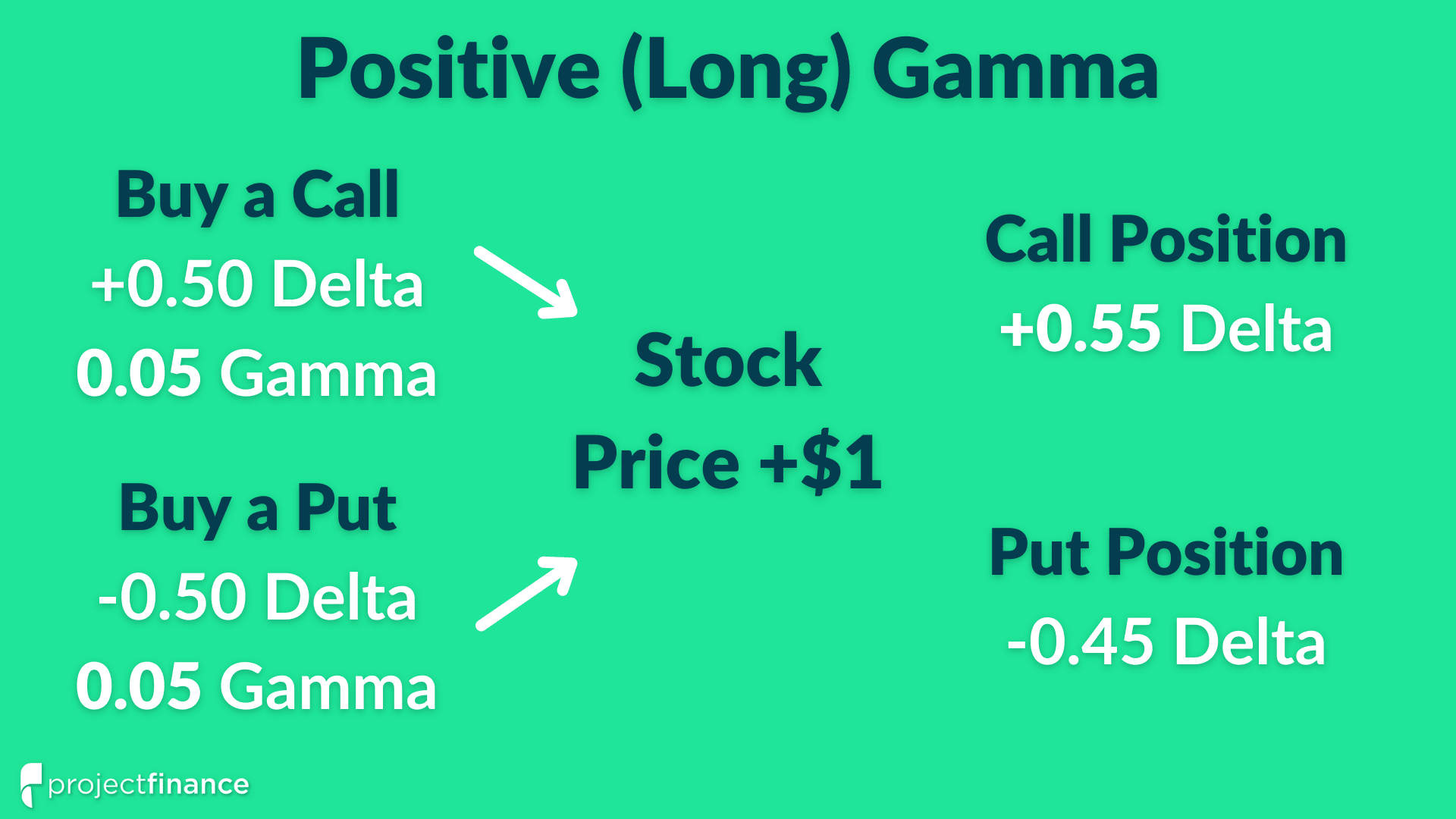

Let’s say you own an option with:

- Delta = -0.40 (meaning for every $1 move in the stock price, your option gains or loses $0.40).

- Gamma = 0.05 (meaning for every $1 move in stock price, Delta changes by 0.05).

If the stock price drops by $1, Delta increases negatively from -0.40 to -0.45. That means the put is becoming more sensitive to future price drops!

This is why understanding Gamma is crucial—it affects how aggressively your option responds to price changes.

How Gamma Works With Delta

Now that we know what Gamma is, let’s explore how it interacts with Delta.

Delta measures direction, Gamma measures acceleration. Think of it this way:

- If Delta is a car’s speed, Gamma is how fast you’re pressing the accelerator.

- A higher Gamma means bigger swings in Delta, leading to faster changes in an option’s price.

For call options, Delta moves from 0 to 1 as the stock rises.

For put options, Delta moves from 0 to -1 as the stock falls.

Now, here’s where things get interesting:

- Long calls and long puts BOTH have positive Gamma (we’ll explain why soon).

- Short calls and short puts BOTH have negative Gamma (meaning Delta moves against them).

| Option Position | Initial Delta | Gamma Effect | Result |

|---|---|---|---|

| Long Call | +0.40 | Positive | Delta increases as stock rises |

| Short Call | -0.40 | Negative | Delta decreases, working against the trader |

| Long Put | -0.40 | Positive | Delta becomes more negative as stock falls |

| Short Put | +0.40 | Negative | Delta decreases, making it harder to profit |

Notice something? Both long positions (calls and puts) have positive Gamma—this is the key to understanding why Gamma is positive for a long put.

What Is a Long Put?

Now that we’ve covered Gamma and Delta, let’s talk about the long put—the star of our discussion. If you’re wondering why Gamma is positive for a long put, you first need to understand how a long put works.

Definition of a Long Put Position

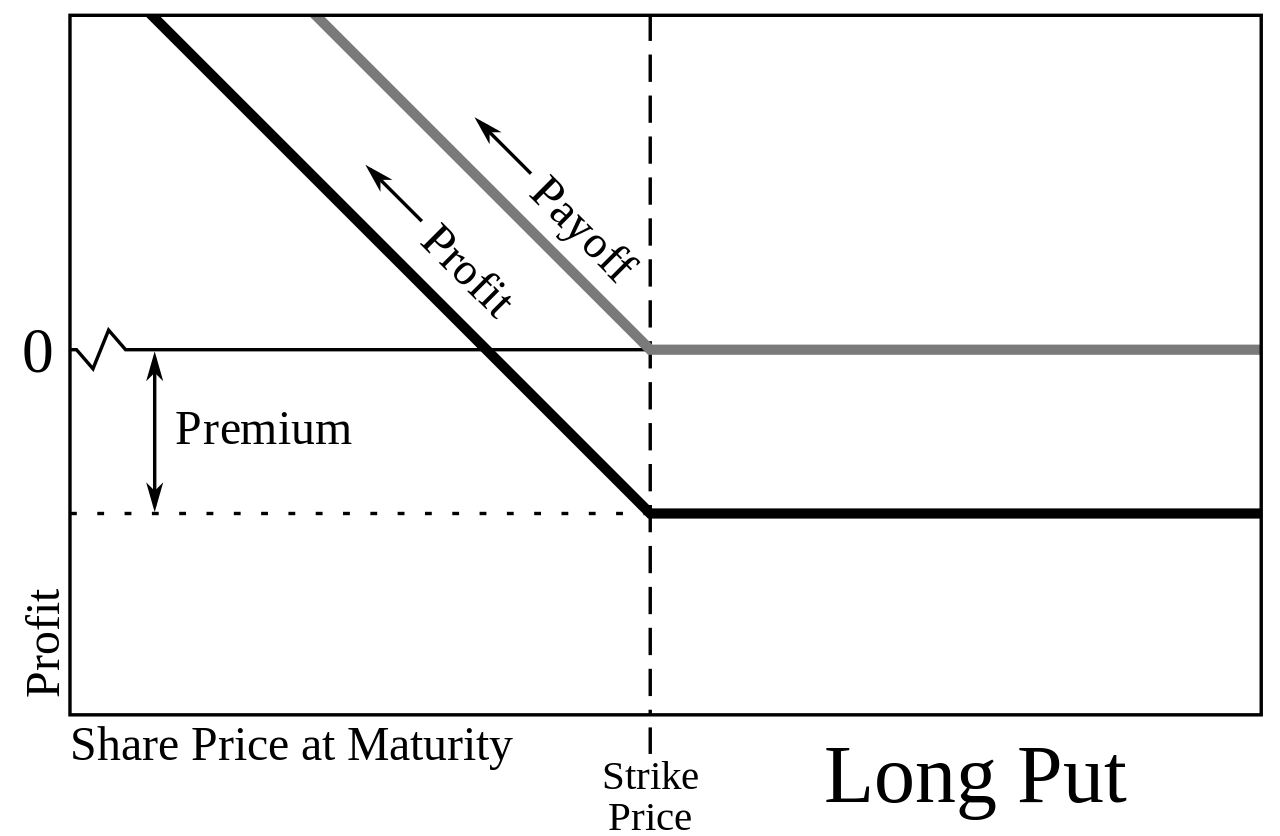

A long put is an options position where you buy a put contract, giving you the right (but not the obligation) to sell the underlying stock at a predetermined price (strike price) before the contract expires.

Traders use long puts for one main reason: to profit from a falling stock price.

Here’s a simple breakdown of how a long put works:

- If the stock price drops, the put option gains value because you can sell the stock at a higher, pre-agreed price.

- If the stock price rises, the put option loses value since selling the stock at a lower price makes no sense.

- The maximum risk is limited to the premium paid for the option.

Payoff Structure of a Long Put

The potential outcomes of a long put are straightforward:

| Stock Price at Expiration | Profit/Loss | Outcome |

|---|---|---|

| Well below strike price | Large profit | Put is in-the-money (ITM), high value |

| At strike price | Small loss | Put has little value, loss = premium paid |

| Well above strike price | Full loss | Put is out-of-the-money (OTM), expires worthless |

Key Characteristics of a Long Put

A long put has three defining features:

- Limited Risk, High Reward Potential

- The maximum loss is the premium paid.

- The maximum gain is large (if the stock drops significantly).

- Theta (Time Decay) Works Against You

- Options lose value as expiration approaches.

- If the stock doesn’t drop fast enough, the put option’s value declines.

- Implied Volatility Boosts Value

- Higher volatility increases put premiums.

- More uncertainty = greater potential for large price moves.

Why This Matters for Gamma

Here’s where it gets interesting. Since a long put becomes more profitable as the stock falls, its Delta moves further into negative territory.

For example:

- A long put starts with Delta = -0.40.

- As the stock drops, Delta moves to -0.50, then -0.60, and so on.

- This increasing negativity is caused by Gamma, which is positive.

This is exactly why Gamma is positive for a long put. As the stock price declines, the put option reacts more aggressively, increasing its profit potential.

Why Is Gamma Positive for a Long Put?

Now, let’s answer the big question: Why is Gamma positive for a long put? At first, it might seem confusing. A long put makes money when the stock price falls, so why would it have similar Gamma behavior to a long call, which benefits from price increases?

The answer lies in how Gamma affects Delta—and once you understand this relationship, it all makes perfect sense.

How Gamma Affects a Long Put Position

As we discussed earlier, Gamma measures how Delta changes when the stock price moves.

- A long put starts with a negative Delta (because put values increase as stocks fall).

- As the stock price drops, Delta becomes more negative (meaning the put gains value more aggressively).

- Gamma is what controls this acceleration of Delta.

Since Gamma measures the rate of Delta’s change, it must be positive to push Delta further negative as the stock price declines.

Here’s an example:

| Stock Price Movement | Delta Before Move | Gamma | New Delta |

|---|---|---|---|

| Stock falls $1 | -0.40 | +0.05 | -0.45 |

| Stock falls another $1 | -0.45 | +0.05 | -0.50 |

| Stock falls again | -0.50 | +0.05 | -0.55 |

Notice how Delta is getting more negative? That’s positive Gamma at work.

If Gamma were negative, Delta would be moving in the opposite direction, which would make no sense for a long put. Instead of benefiting from a falling stock, a negative Gamma would reduce the put’s profitability—which is not how puts are designed to work.

Mathematical Explanation of Gamma for a Long Put

For those who like a more technical breakdown, let’s look at the mathematics behind Gamma.

Gamma is calculated as the second derivative of an option’s price with respect to the underlying stock price. That means:

Γ=∂2OptionPrice∂StockPrice2\Gamma = \frac{\partial^2 Option Price}{\partial Stock Price^2}

Since both calls and puts have a curved price relationship with stock movement, their Gamma values are always positive for long positions.

For example, if we use the Black-Scholes Model, Gamma is given by:

Γ=e−rTN′(d1)SσT\Gamma = \frac{e^{-rT} N'(d_1)}{S \sigma \sqrt{T}}

Where:

- N’(d₁) is the normal distribution function.

- S is the stock price.

- σ is volatility.

- T is time to expiration.

- r is the risk-free rate.

Since all of these values remain positive, Gamma is always positive for a long put—meaning Delta will always increase (in the negative direction) as the stock price drops.

Intuitive Explanation: Why Gamma Is Positive for a Long Put

If you’re not a fan of math, don’t worry. Here’s a simple analogy to help you understand why Gamma is positive for a long put:

Think of a long put like pressing the gas pedal on a downhill road.

- At first, your car (Delta) is moving slowly.

- But as you continue downhill (stock price drops), you start picking up speed (Delta becomes more negative).

- The further you go, the faster you move—because gravity (Gamma) is increasing your acceleration (Delta).

This is exactly how Gamma works for a long put. It pushes Delta to react faster as the stock drops, making the put more valuable.

Real-World Example of Gamma in Action

Let’s say you buy a put option on Tesla (TSLA) when the stock is trading at $250. Your option has:

- Delta = -0.40

- Gamma = +0.05

Now, Tesla’s stock falls to $240. What happens?

- Your Delta becomes -0.50 (due to positive Gamma).

- Your put option gains value faster than expected because Delta is increasing negatively.

- If Tesla continues to fall, your put option will become more sensitive to price drops, making it even more profitable.

This accelerating profitability is why traders love positive Gamma when buying options. It means their positions become more rewarding as the stock moves in their favor.

- Gamma is always positive for long options (both calls and puts).

- A positive Gamma means Delta increases in its respective direction (for puts, this means becoming more negative).

- Without positive Gamma, puts wouldn’t benefit as much from falling stock prices.

- The more Delta moves, the faster the option gains value—making long puts a powerful tool in a declining market.

Comparing Gamma in Long and Short Options

Now that we know why Gamma is positive for a long put, let’s take a step back and compare Gamma’s behavior across different options positions. This will help solidify our understanding and highlight why long options (both calls and puts) always have positive Gamma, while short options have negative Gamma.

Why Gamma Is Negative for Short Puts and Short Calls

When you sell an option (short position), you take the opposite side of the trade. This means your Delta behaves in the opposite direction of a long position.

- A short call has a negative Delta that moves toward zero as the stock price rises.

- A short put has a positive Delta that moves toward zero as the stock price falls.

Since Gamma measures the rate of change of Delta, and Delta is moving against the trader in a short position, Gamma becomes negative.

Here’s a quick way to think about it:

- Long options benefit from movement (positive Gamma).

- Short options suffer from movement (negative Gamma).

This is why short options traders (especially market makers) often hedge their positions to neutralize Gamma exposure—because negative Gamma makes their positions harder to manage in volatile markets.

Gamma Behavior for Long vs. Short Options

Let’s break it down into a simple table for clarity:

| Option Position | Delta Behavior | Gamma Sign | Effect on Position |

|---|---|---|---|

| Long Call | Increases as stock rises | Positive | Helps position as stock rises |

| Short Call | Decreases as stock rises | Negative | Hurts position as stock rises |

| Long Put | Becomes more negative as stock falls | Positive | Helps position as stock falls |

| Short Put | Becomes less negative as stock falls | Negative | Hurts position as stock falls |

As you can see, Gamma is always positive for long options and always negative for short options.

Why Does This Matter for Traders?

Understanding Gamma behavior across different positions helps traders make informed decisions.

Here’s how Gamma affects real-world trading strategies:

- Long Options Traders (Positive Gamma)

- Benefit from big price moves.

- The more the stock moves, the more profitable the option becomes.

- Works best when expecting high volatility.

- Short Options Traders (Negative Gamma)

- Suffer when the stock moves aggressively.

- Need the stock to stay in a narrow price range to avoid losses.

- Often hedge positions to neutralize Gamma risk.

Real-World Example: The Danger of Negative Gamma

Let’s say a trader sells a short put on Apple (AAPL) at $150, collecting a premium of $5 per contract.

- The trader wants Apple to stay above $150 so the put expires worthless.

- Initially, Delta is +0.40 (because short puts have positive Delta).

- Gamma is -0.05, meaning Delta decreases as Apple’s stock falls.

Now, imagine Apple’s stock suddenly drops to $140:

- Delta moves from +0.40 to +0.50, meaning the trader’s position is losing money faster.

- Since Gamma is negative, Delta moves against the trader’s favor, making losses accelerate.

- If the trader doesn’t hedge, the losses could snowball quickly.

This is why traders who sell options need to carefully manage Gamma risk. Negative Gamma means the trade works as long as the stock doesn’t move much, but if it does, things can go south fast.

Comparing Gamma in Long and Short Options

- Long options (calls and puts) have positive Gamma, meaning they benefit from stock price movement.

- Short options (calls and puts) have negative Gamma, meaning they suffer from stock price movement.

- Positive Gamma accelerates profitability when the stock moves in the expected direction.

- Negative Gamma increases risk, making short option positions harder to manage when the stock moves aggressively.

This is why traders who buy options love Gamma, while traders who sell options fear it.