Options trading is full of complex terms, strategies, and market dynamics that can confuse even experienced traders. Among the most important concepts in options pricing are the Greeks—key metrics that help traders understand risk and sensitivity. Two of the most discussed Greeks are gamma and vega, which measure how an option’s delta and price change with market fluctuations.

Now, the burning question: Can you be long gamma and short vega at the same time? At first glance, it might seem like these two are tied together—if you’re long gamma, you’re probably also long vega. But there are scenarios where you can structure trades to have positive gamma exposure while reducing or even shorting vega. Understanding these situations can give traders an edge, especially in volatile or uncertain markets.

What Is Gamma in Options Trading?

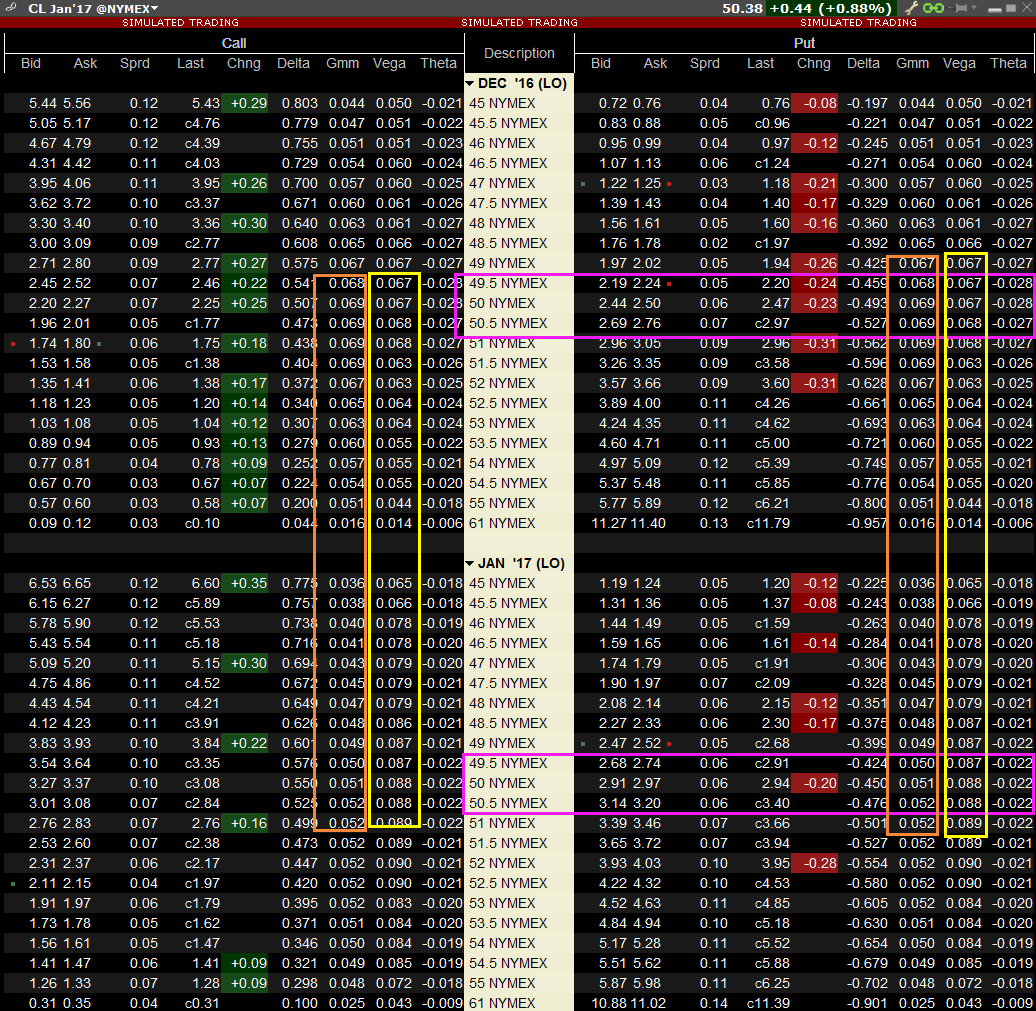

Gamma measures how much an option’s delta changes as the underlying price moves.

To put it simply:

- Delta tells you how much the option price changes based on the movement of the underlying asset.

- Gamma tells you how much delta will change when the underlying price moves.

Key Facts About Gamma:

- Gamma is highest for at-the-money options and decreases as the option moves further in- or out-of-the-money.

- Gamma is always positive for long options (calls or puts). This means the delta of a long option will increase as the trade moves in your favor.

- Short options have negative gamma, which means delta moves against the trader if the underlying price changes.

- Gamma is more significant in short-term options. Longer-dated options have lower gamma because their delta doesn’t change as dramatically.

Example of Gamma in Action

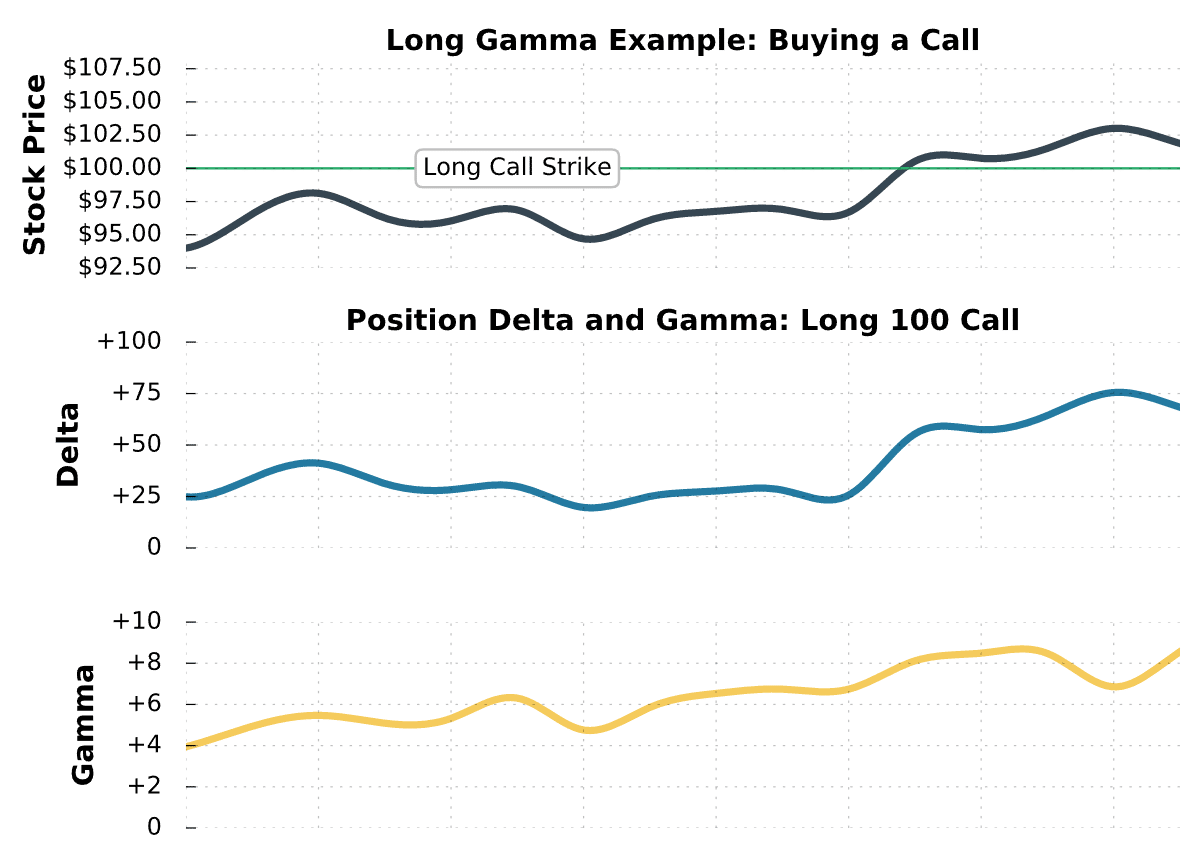

Imagine you buy a call option with a delta of 0.50 and a gamma of 0.10. If the stock price rises by $1, delta will increase by 0.10, moving from 0.50 to 0.60. This means your option now behaves more like owning 60 shares instead of 50.

This acceleration effect is why traders love long gamma—it allows them to profit from large directional moves without having to constantly adjust their positions.

What Is Vega in Options Trading?

Vega measures how much an option’s price changes in response to changes in implied volatility.

Implied volatility (IV) reflects how much the market expects the underlying asset to move in the future. Higher IV generally means higher option prices because there’s more uncertainty.

Key Facts About Vega:

- Vega is highest for at-the-money options and decreases as the option moves further in- or out-of-the-money.

- Long options (calls or puts) have positive vega, meaning their price increases when IV rises.

- Short options have negative vega, meaning they lose value if IV spikes.

- Vega is more significant in long-term options. The further out an option’s expiration, the more sensitive it is to changes in IV.

Example of Vega in Action

Imagine you own an at-the-money call option priced at $5.00 with a vega of 0.20. If implied volatility increases by 1%, the option’s price will rise to $5.20. Conversely, if IV drops by 1%, the option price will decrease to $4.80.

This is why traders long vega benefit from rising volatility and why short vega positions can be dangerous in highly uncertain markets.

The Relationship Between Gamma and Vega

At this point, you might be thinking: If gamma and vega are both highest for at-the-money options, aren’t they always correlated?

For most standard options positions, this is true:

- If you’re long gamma, you’re usually also long vega.

- If you’re short gamma, you’re usually also short vega.

This makes sense because at-the-money options, which have the highest gamma, also tend to have high vega sensitivity. As volatility increases, the price of the option rises, benefiting a long options holder.

Is It Possible to Be Long Gamma and Short Vega?

At first glance, it seems counterintuitive. Gamma and vega usually move together—if you’re long gamma, you’re typically also long vega. But, as with most things in options trading, there are exceptions.

Yes, you can be long gamma and short vega, but it requires specific strategies and trade structures. These setups involve:

- Creating exposure to price movement (gamma) while limiting exposure to volatility (vega).

- Using spreads and specific expirations to separate these two sensitivities.

Let’s break down exactly how this is possible.

Theoretically, Can You Be Long Gamma and Short Vega?

To understand this, recall how gamma and vega behave:

- Gamma is highest for short-term at-the-money options.

- Vega is highest for longer-term options.

This means you can construct a position where you gain positive gamma from short-term options while offsetting vega with longer-term options.

Here’s a simple way to think about it:

- Short-term options have high gamma but relatively low vega.

- Long-term options have high vega but relatively low gamma.

- If you’re long short-term options and short longer-term options, you can be long gamma while keeping vega neutral or even negative.

Now let’s look at some practical strategies that achieve this.

Real-World Strategies That Achieve Long Gamma, Short Vega

There are specific options trades that allow you to be long gamma while maintaining a short vega exposure. Some of the most common ones include:

1. Ratio Spreads

A ratio spread involves buying one option and selling multiple options of a different strike price in the same expiration.

- Example: Buying one at-the-money call and selling two out-of-the-money calls.

- Why it works: The long call has high gamma, but the additional short calls contribute negative vega exposure.

However, ratio spreads come with risks:

- If the stock moves too far in one direction, losses can be substantial.

- You must manage the position carefully as expiration approaches.

2. Calendar Spreads (Reverse Calendars)

A reverse calendar spread (selling long-term options and buying short-term ones) can create long gamma and short vega exposure.

- Example: Selling a three-month at-the-money option while buying a one-week at-the-money option.

- Why it works:

- The short-term option provides gamma exposure.

- The long-term short option reduces vega exposure, since longer-term options are more sensitive to changes in volatility.

The key risk? If implied volatility increases, the short vega exposure can work against you. These trades perform best in stable or falling IV environments.

3. Short Vega in High Volatility Environments

Another scenario where traders aim to be long gamma but short vega is when implied volatility is unusually high.

- If the market is pricing in excessive volatility, traders may want to bet on actual movement (gamma) while avoiding IV exposure.

- Example: Buying a short-term at-the-money straddle while selling a longer-term straddle.

- Why it works:

- The short-term options benefit from sharp moves.

- The longer-term short options benefit if IV drops.

This setup works best when markets are expecting extreme moves but actual volatility turns out lower than implied.

Examples of Long Gamma, Short Vega in Different Market Conditions

| Market Condition | Best Trade Setup | Why It Works |

|---|---|---|

| High implied volatility | Short long-term options, long short-term options | Reduces vega risk while profiting from price swings |

| Stable or declining IV | Reverse calendar spreads | Capitalizes on short-term moves while shorting vega |

| Strong directional bias | Ratio spreads | Gains gamma while limiting vega exposure |

While long gamma and long vega usually go hand-in-hand, strategic trade construction allows you to separate these exposures.

Pros and Cons of Being Long Gamma and Short Vega

Now that we know it is possible to be long gamma and short vega, the next question is: Should you?

This setup isn’t for everyone. Like all options strategies, it comes with benefits and risks that depend on market conditions, trading objectives, and risk tolerance.

Let’s break it down.

Benefits of Being Long Gamma and Short Vega

- Profits from Large Price Moves Without Relying on Volatility

- Being long gamma means your position benefits from sharp moves in the underlying stock.

- Unlike a traditional long option position, this setup doesn’t rely on increasing volatility (vega) to make money.

- This is especially useful in markets where actual movement is high but implied volatility is overpriced (such as after major news events).

- More Control Over Vega Risk

- Long vega positions can be tricky in certain environments, especially if implied volatility suddenly drops.

- By structuring trades that reduce vega exposure, traders avoid sudden IV collapses that can hurt long options positions.

- Great for Short-Term Trading

- Since gamma is strongest in short-term options, traders can take advantage of price swings within days or even hours.

- This is particularly useful for day traders or event-driven traders who don’t want to hold positions for long periods.

- Can Be Used to Exploit Overpriced Volatility

- Market participants often overestimate future volatility, especially ahead of major events like earnings, Federal Reserve meetings, or economic reports.

- A long gamma, short vega setup allows traders to profit from price movement while betting against overinflated volatility expectations.

Risks and Drawbacks of This Strategy

- High Cost of Maintaining the Position

- Short-term options have higher gamma, but they also experience rapid time decay (theta).

- Holding these positions requires frequent adjustments or rolling into new contracts, increasing costs.

- Loses Money in Quiet Markets

- If the stock doesn’t move significantly, gamma won’t help, and the short vega exposure won’t be enough to generate profit.

- This means the strategy underperforms in low-volatility, range-bound markets.

- Requires Active Management

- Being long gamma often involves delta hedging (adjusting the position as the stock moves).

- Traders must monitor the trade daily (or even intra-day) to ensure it remains effective.

- For passive investors, this level of maintenance can be impractical.

- Vega Risk Can Still Hurt in Certain Conditions

- While short vega exposure can be beneficial in a declining IV environment, a sudden spike in implied volatility can still cause losses.

- If the market enters a panic phase, even a well-structured long gamma, short vega position can suffer from higher option prices on the short leg of the trade.

When Does This Strategy Work Best?

| Market Condition | Is Long Gamma, Short Vega Effective? | Why? |

|---|---|---|

| High Implied Volatility (IV) | ✅ Yes | Can take advantage of overpriced IV while benefiting from price swings. |

| Low Volatility, Sideways Market | ❌ No | Gamma exposure won’t help if the stock isn’t moving. |

| Event-Driven Market (Earnings, Fed Meetings, etc.) | ✅ Yes | Profits from actual price movement, while short vega protects against IV crush. |

| Panic Selling or Market Crashes | ❌ Risky | Short vega can hurt if IV keeps rising unpredictably. |

When Should You Use This Strategy?

Being long gamma and short vega is a powerful strategy but requires a specific market environment to be effective. It’s best suited for:

✔ Short-term traders who can actively manage positions

✔ Markets where implied volatility is overpriced

✔ Event-driven trading (earnings, news releases, major economic events)

It is not ideal for passive investors or those looking for set-it-and-forget-it trades.